Dive into the captivating realm of business inventory exemption, where we unravel the intricacies of this legal concept. From understanding its fundamentals to navigating state-specific variations, this comprehensive guide empowers businesses to optimize their tax strategies and ensure compliance.

Business inventory exemption plays a pivotal role in shaping sales tax obligations, offering significant benefits to eligible businesses. By delving into the qualifying criteria, documentation requirements, and compliance responsibilities, we provide a roadmap for businesses to leverage this exemption effectively.

Business Inventory Exemption Overview

The business inventory exemption is a tax break that allows businesses to avoid paying sales tax on certain types of inventory. This exemption can save businesses a significant amount of money, especially those that have a large amount of inventory on hand.

To qualify for the business inventory exemption, a business must meet the following requirements:

- The business must be engaged in the sale of tangible personal property.

- The inventory must be held for sale in the ordinary course of business.

- The inventory must not be held for lease or rental.

Examples of businesses that qualify for the business inventory exemption include:

- Retail stores

- Wholesalers

- Manufacturers

Qualifying Criteria for Business Inventory Exemption

To qualify for the business inventory exemption, businesses must meet specific criteria established by the relevant tax authorities. These criteria vary depending on the jurisdiction, but generally, the following requirements apply:

- Ownership:The business must have legal ownership or possession of the inventory.

- Intent to sell:The inventory must be held for sale or lease in the ordinary course of business.

- Physical presence:The inventory must be physically located within the jurisdiction where the exemption is claimed.

- Time limits:The inventory must be held for a specified period, typically a minimum of 12 months.

Exceptions and Special ConsiderationsIn certain cases, exceptions or special considerations may apply to the qualifying criteria. For instance, some jurisdictions may extend the exemption to raw materials and supplies used in the production process. Additionally, businesses may be eligible for partial exemptions if they meet certain conditions.

Table Summarizing the Requirements| Requirement | Description ||—|—|| Ownership | Legal ownership or possession of the inventory || Intent to sell | Inventory held for sale or lease in the ordinary course of business || Physical presence | Inventory located within the jurisdiction where the exemption is claimed || Time limits | Inventory held for a specified period, typically a minimum of 12 months || Exceptions | Raw materials and supplies used in production may be eligible for exemption || Special considerations | Partial exemptions may be available in certain cases |

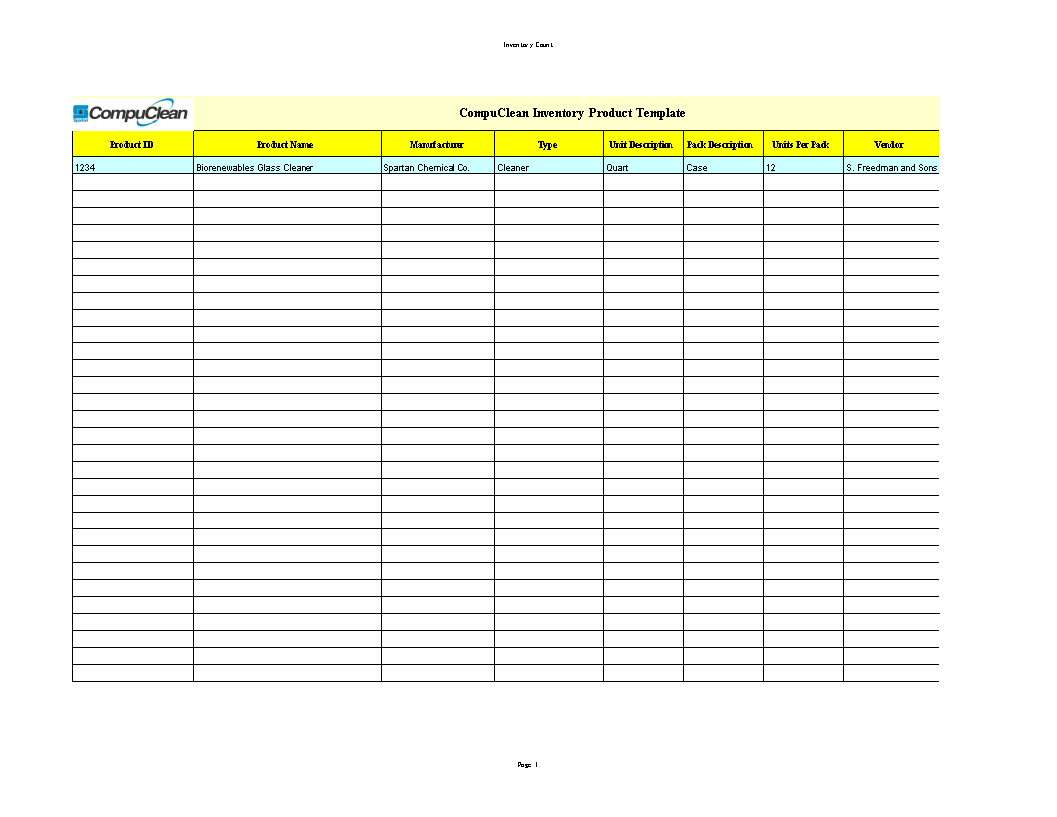

Documentation and Recordkeeping Requirements

Proper documentation and recordkeeping are essential for supporting a business inventory exemption claim and demonstrating compliance with the exemption criteria. Failure to maintain accurate records can result in the denial of the exemption, leading to additional tax liability.

Documentation Required

- Proof of ownership of the inventory, such as purchase orders, invoices, or receipts.

- Records showing the location of the inventory, including the physical address and storage method.

- Documentation of the intended use of the inventory, such as sales records or production schedules.

- Evidence of the inventory’s status as raw materials, work in progress, or finished goods.

- Records of inventory movement, including receipts, shipments, and adjustments.

Importance of Maintaining Accurate Records

Accurate records are crucial for:

- Substantiating the exemption claim.

- Tracking inventory levels and preventing theft or loss.

- Complying with tax audits and other legal requirements.

- Making informed business decisions.

Recommended Recordkeeping Practices

- Establish a system for tracking inventory from acquisition to sale.

- Use technology, such as inventory management software, to automate recordkeeping.

- Regularly reconcile inventory records with physical counts.

- Retain records for the required period, typically several years.

- Train staff on proper inventory management and recordkeeping procedures.

Sales Tax Implications of Business Inventory Exemption

Claiming the business inventory exemption has significant implications for sales tax liability. By exempting the value of inventory from sales tax, businesses can reduce their overall tax burden and increase their profitability.

Impact on Sales of Inventory

The business inventory exemption applies to sales of inventory. This means that when a business sells inventory, it does not have to pay sales tax on the portion of the sales price that represents the value of the inventory. For example, if a business sells a product for $100 and the cost of goods sold is $50, the business would only pay sales tax on the $50 profit margin.

Examples, Business inventory exemption

- A retail store that sells clothing would be exempt from paying sales tax on the clothing it has in stock.

- A manufacturer that produces widgets would be exempt from paying sales tax on the widgets it has in its warehouse.

- A distributor that sells products to other businesses would be exempt from paying sales tax on the products it has in its inventory.

State-Specific Variations in Business Inventory Exemption Laws

The business inventory exemption laws vary across different states, resulting in a diverse landscape of regulations. Understanding these variations is crucial for businesses operating in multiple jurisdictions or planning to expand their operations across state lines.

The following table provides a comparative overview of the key provisions of the business inventory exemption in several states:

Key Provisions

| State | Definition of Business Inventory | Exempt Property | Exemption Threshold |

|---|---|---|---|

| California | Tangible personal property held for sale or lease in the ordinary course of business | Raw materials, work in progress, finished goods | $50,000 |

| Florida | Tangible personal property held for sale at retail | Inventory intended for immediate sale | None |

| Illinois | Tangible personal property held for sale or lease in the ordinary course of business | Raw materials, work in progress, finished goods | $100,000 |

| New York | Tangible personal property held for sale in the ordinary course of business | Raw materials, work in progress, finished goods | $50,000 |

| Texas | Tangible personal property held for sale in the ordinary course of business | Inventory intended for immediate sale | $5,000 |

As evident from the table, states have different definitions of business inventory, exempt property, and exemption thresholds. Some states, like California and Illinois, define business inventory broadly, including raw materials and work in progress. Others, like Florida and Texas, have a narrower definition, focusing solely on inventory intended for immediate sale.

The exemption threshold also varies significantly. For instance, California and New York have a relatively high threshold of $50,000, while Texas has a low threshold of $5,000. This means that businesses in Texas may qualify for the exemption on a smaller amount of inventory compared to businesses in other states.

Additionally, some states have unique or noteworthy requirements. For example, California requires businesses to maintain detailed records of their inventory, including the cost of each item and the date it was acquired. Florida, on the other hand, has a “use tax” that applies to inventory that is used or consumed in the state, even if it was purchased tax-free in another state.

Compliance and Enforcement

Businesses have a responsibility to comply with business inventory exemption laws to avoid penalties and ensure accurate tax reporting.

Failure to comply can result in additional taxes, interest, and penalties, as well as potential legal consequences.

Tips for Ensuring Compliance

- Maintain accurate records:Keep detailed records of all inventory, including purchases, sales, and transfers.

- Understand the specific requirements:Familiarize yourself with the laws and regulations in your state regarding business inventory exemptions.

- File exemption certificates:Submit the necessary exemption certificates to the appropriate tax authorities.

- Cooperate with audits:Be prepared to provide documentation and answer questions during audits.

Recent Developments and Trends in Business Inventory Exemption Laws

In recent years, several states have enacted new laws or amended existing laws related to business inventory exemptions. These changes have been driven by a variety of factors, including the growth of e-commerce, the increasing complexity of supply chains, and the desire to provide businesses with tax relief.One significant trend has been the expansion of the definition of “business inventory” to include a wider range of goods.

For example, some states have now explicitly included raw materials, work-in-process, and finished goods in their definitions. This has made it easier for businesses to qualify for the exemption, even if they do not maintain a traditional inventory system.Another trend has been the adoption of “safe harbor” provisions that provide businesses with certainty regarding the taxability of their inventory.

These provisions typically specify a minimum holding period or a maximum percentage of inventory that can be sold without losing the exemption. This gives businesses peace of mind and reduces the risk of disputes with tax authorities.In addition, some states have implemented new rules for the documentation and recordkeeping requirements associated with the business inventory exemption.

These rules are designed to ensure that businesses are properly claiming the exemption and to prevent fraud.Overall, the recent developments and trends in business inventory exemption laws have been positive for businesses. The expanded definitions, safe harbor provisions, and streamlined documentation requirements have made it easier for businesses to comply with the law and to take advantage of the exemption.

Emerging Trends

Several emerging trends are expected to continue to shape business inventory exemption laws in the coming years. These trends include:

- The continued growth of e-commerce will lead to further changes in the definition of “business inventory.” For example, some states may begin to include digital goods, such as software and music, in their definitions.

- The increasing complexity of supply chains will make it more difficult for businesses to track and manage their inventory. This could lead to more disputes with tax authorities over the taxability of inventory.

- The desire for tax relief will continue to drive states to adopt new business inventory exemption laws or to expand existing laws.

Businesses should be aware of these emerging trends and how they could impact their tax liability. They should also consult with a tax advisor to ensure that they are complying with the latest laws and regulations.

Ultimate Conclusion

In the ever-evolving landscape of tax regulations, staying abreast of recent developments and trends in business inventory exemption laws is paramount. This guide serves as an invaluable resource, equipping businesses with the knowledge and insights they need to navigate this complex terrain confidently.

General Inquiries

What types of businesses qualify for the business inventory exemption?

Businesses that primarily sell tangible personal property for resale or use as a component part of a product for sale are typically eligible for the exemption.

What documentation is required to support a business inventory exemption claim?

Businesses may need to provide invoices, purchase orders, inventory records, and other relevant documentation to substantiate their exemption claims.

How does the business inventory exemption affect sales tax liability?

The exemption reduces or eliminates sales tax liability on the sale of qualifying inventory items, resulting in significant tax savings for eligible businesses.