In the realm of business, inventory plays a pivotal role, and safeguarding it through insurance is paramount. Business Inventory for Insurance Purposes delves into the intricacies of protecting your assets, minimizing risks, and ensuring financial stability.

This comprehensive guide unravels the complexities of inventory management, insurance coverage, valuation methods, and special considerations for high-value inventory. By equipping you with knowledge and best practices, we empower you to navigate the insurance landscape confidently and secure your business against unforeseen events.

Business Inventory Definition

Business inventory refers to the raw materials, work-in-progress, and finished goods that a company holds for the purpose of selling them to customers. It is a crucial aspect of insurance coverage, as it determines the amount of compensation a business can receive in the event of a loss.

Business inventories can be classified into various types based on their nature and stage of production. These include raw materials, components, work-in-progress, finished goods, and supplies.

Valuation Methods

The valuation of business inventories is essential for determining their insurable value. Common valuation methods include:

- FIFO (First-In, First-Out):This method assumes that the oldest inventory items are sold first, resulting in a higher cost of goods sold and a lower inventory value.

- LIFO (Last-In, First-Out):This method assumes that the most recently acquired inventory items are sold first, resulting in a lower cost of goods sold and a higher inventory value.

- Average Cost:This method calculates the average cost of inventory items by dividing the total cost of goods available for sale by the total number of units.

Inventory Management and Insurance

Inventory management plays a crucial role in minimizing insurance risks for businesses. By implementing effective inventory management practices, businesses can reduce the likelihood of losses due to theft, damage, or obsolescence, thereby potentially lowering their insurance premiums.

Best Practices for Reducing Insurance Premiums

Here are some inventory management best practices that can help reduce insurance premiums:

- Accurate Inventory Records:Maintaining accurate and up-to-date inventory records is essential for insurance purposes. This includes tracking the quantity, value, and location of all inventory items.

- Regular Inventory Audits:Conducting regular inventory audits helps businesses identify discrepancies and prevent losses. Audits should be performed by a third party to ensure accuracy and impartiality.

- Secure Storage:Storing inventory in a secure location can reduce the risk of theft or damage. This may involve installing security systems, using access control measures, and implementing physical barriers.

- Inventory Control Systems:Implementing inventory control systems can help businesses manage inventory levels and prevent overstocking or understocking. These systems can also track inventory movements and identify potential risks.

- Staff Training:Providing staff with proper training on inventory management practices can help prevent losses due to human error. This training should cover topics such as inventory handling, storage, and security.

Insurance Coverage for Business Inventory: Business Inventory For Insurance Purposes

Businesses rely on inventory to meet customer demand and generate revenue. Protecting this valuable asset with appropriate insurance coverage is crucial. Several types of insurance policies offer protection for business inventory, each with its own coverage limits, exclusions, and deductibles.

Types of Inventory Insurance Policies

- Property Insurance:Covers inventory against physical damage or loss due to fire, theft, vandalism, and other covered perils. It typically includes coverage for the inventory’s replacement cost or actual cash value.

- Inland Marine Insurance:Provides coverage for inventory in transit, such as when being shipped or stored off-premises. It covers risks associated with transportation, handling, and storage.

- Business Owner’s Policy (BOP):A package policy that combines property insurance, general liability insurance, and business interruption insurance. It may include coverage for inventory as part of the property insurance component.

- Errors and Omissions (E&O) Insurance:Protects businesses against claims of negligence or errors related to inventory management, such as incorrect inventory counts or lost or damaged inventory due to mismanagement.

Coverage Limits, Exclusions, and Deductibles

The coverage limits for inventory insurance vary depending on the policy and the insurer. Businesses should carefully assess their inventory value and determine the appropriate coverage amount. Exclusions may apply to certain types of inventory or losses, such as perishable goods or inventory stored in hazardous locations.

Deductibles are the amount the business must pay out-of-pocket before the insurance coverage kicks in. Choosing an appropriate deductible balance between affordability and coverage is important.

Inventory Valuation for Insurance Claims

Determining the value of business inventory for insurance claims is crucial for ensuring adequate compensation in the event of a loss. This section will discuss the methods used to value inventory and provide guidance on documenting inventory for insurance purposes.

The most common methods used to determine the value of inventory for insurance claims are:

- Actual Cash Value (ACV):This method considers the current market value of the inventory, taking into account depreciation and any other factors that may affect its worth.

- Replacement Cost:This method calculates the cost of replacing the lost or damaged inventory with new items of similar quality and function.

- Agreed Value:This method involves agreeing on a predetermined value for the inventory before a loss occurs. This value is typically based on the replacement cost and is binding on both the policyholder and the insurance company.

Documenting Inventory for Insurance Purposes

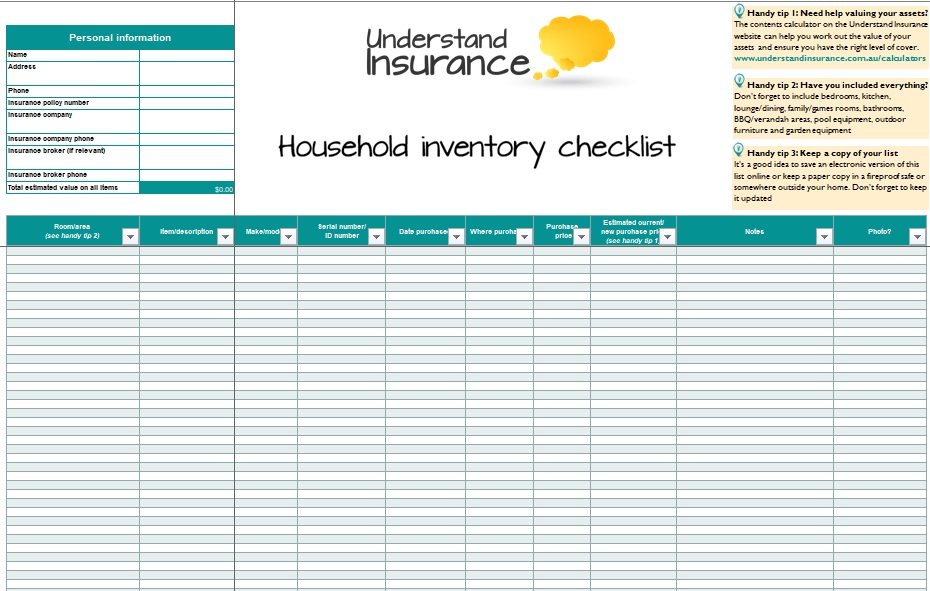

Proper documentation of inventory is essential for accurate insurance claims. The following steps can help businesses maintain organized and up-to-date inventory records:

- Regular Physical Inventory:Conduct regular physical counts of inventory to ensure accuracy and identify any discrepancies.

- Inventory Management System:Use an inventory management system to track inventory levels, costs, and other relevant data.

- Purchase Orders and Invoices:Keep copies of purchase orders and invoices as proof of inventory purchases and values.

- Photos and Videos:Take photos or videos of inventory for documentation purposes, especially for high-value items.

- Documentation of Depreciation:Maintain records of any depreciation or write-downs applied to inventory over time.

By following these guidelines, businesses can ensure that their inventory is properly valued and documented for insurance purposes, facilitating accurate and timely claims settlements in the event of a loss.

Special Considerations for High-Value Inventory

Businesses with high-value inventory face unique challenges when it comes to insurance. The value of the assets, their vulnerability to theft or damage, and the potential for significant financial loss necessitate additional security measures and insurance requirements.

Additional Security Measures

- Enhanced surveillance systems:CCTV cameras, motion detectors, and access control systems provide real-time monitoring and deter potential threats.

- Physical barriers:Reinforced walls, doors, and windows, as well as security fencing, create physical barriers to prevent unauthorized access.

- Security personnel:Trained security guards or off-site monitoring services provide a visible deterrent and can respond to incidents quickly.

Insurance Requirements

- Higher insurance limits:The value of high-value inventory often exceeds standard coverage limits, requiring businesses to purchase additional insurance.

- Specialized endorsements:Endorsements can extend coverage to include specific risks, such as theft of high-value items or damage caused by natural disasters.

- Scheduled property coverage:This type of coverage provides specific protection for individual high-value items, ensuring adequate compensation in case of loss.

Inventory Insurance Case Studies

Inventory insurance claims can be complex and challenging, but successful resolutions are possible with proper planning and documentation. Here are some case studies that illustrate the factors that contributed to successful inventory insurance claims:

Case Study 1: Fire Damage to a Warehouse, Business inventory for insurance purposes

A warehouse storing electronics and appliances was destroyed in a fire. The business had comprehensive inventory insurance, which covered the replacement cost of the inventory. The business was able to provide detailed inventory records and proof of ownership, which helped to expedite the claims process.

The insurance company quickly released funds to replace the lost inventory, allowing the business to resume operations promptly.

Case Study 2: Theft from a Retail Store

A retail store was burglarized, and a significant amount of merchandise was stolen. The store had a commercial crime insurance policy, which covered the loss of inventory due to theft. The store had implemented strong security measures, including surveillance cameras and motion sensors.

These measures helped to identify the suspects and recover some of the stolen merchandise. The insurance company worked with the store to assess the loss and provide a fair settlement.

Factors Contributing to Successful Resolution

These case studies highlight the following factors that contributed to the successful resolution of the inventory insurance claims:

Detailed inventory records

Maintaining accurate and up-to-date inventory records is crucial for proving the value of the lost or damaged inventory.

Proof of ownership

Businesses should keep documentation such as purchase orders, invoices, and receipts to demonstrate their ownership of the inventory.

Strong security measures

Implementing robust security measures can help prevent losses and demonstrate that the business has taken reasonable steps to protect its inventory.

Cooperation with the insurance company

Businesses should work closely with their insurance company to provide all necessary information and documentation to support their claim.

Closing Notes

In conclusion, business inventory insurance serves as a lifeline, protecting your assets and ensuring the continuity of your operations. By understanding the nuances of inventory management, insurance coverage, and valuation methods, you can tailor an insurance plan that meets the unique needs of your business.

Embrace the insights provided in this guide to safeguard your inventory, minimize risks, and foster a resilient business foundation.

Questions Often Asked

What types of business inventory are insurable?

Most types of business inventory are insurable, including raw materials, work-in-progress, finished goods, and supplies.

How is business inventory valued for insurance purposes?

Inventory is typically valued at its actual cash value (ACV) or replacement cost.

What are the common exclusions in business inventory insurance policies?

Common exclusions include theft by employees, damage due to war or terrorism, and spoilage.