Delving into the world of accounting and inventory management software for small businesses, this comprehensive guide unravels the intricacies of these essential tools. From unlocking their transformative benefits to exploring their diverse features, this narrative empowers entrepreneurs with the knowledge to make informed decisions and optimize their operations.

As small businesses navigate the ever-evolving landscape of commerce, the adoption of accounting and inventory management software has become paramount. These innovative solutions streamline financial processes, enhance inventory control, and provide valuable insights that drive growth and profitability.

Software Overview

Accounting and inventory management software can streamline your business processes, saving you time and money. This software can help you track your income and expenses, manage your inventory, and generate reports that can help you make informed decisions about your business.

Key features and functionalities of accounting and inventory management software include:

Accounting Features

- Tracking income and expenses

- Managing accounts receivable and accounts payable

- Generating financial reports

- Preparing tax returns

Inventory Management Features

- Tracking inventory levels

- Managing purchase orders and sales orders

- Generating inventory reports

- Setting reorder points

Types of Software

Accounting and inventory management software come in various types, each with its own advantages and disadvantages. Understanding these types can help you choose the right solution for your small business.

The two main types of accounting and inventory management software are:

- Cloud-based software: This software is hosted on a remote server and can be accessed from anywhere with an internet connection. It is often more affordable and easier to use than on-premise software.

- On-premise software: This software is installed on your own computer or server. It is generally more expensive and requires more technical expertise to maintain than cloud-based software.

Within these two main types, there are several different sub-types of accounting and inventory management software, each designed to meet the specific needs of different businesses.

Cloud-based Software

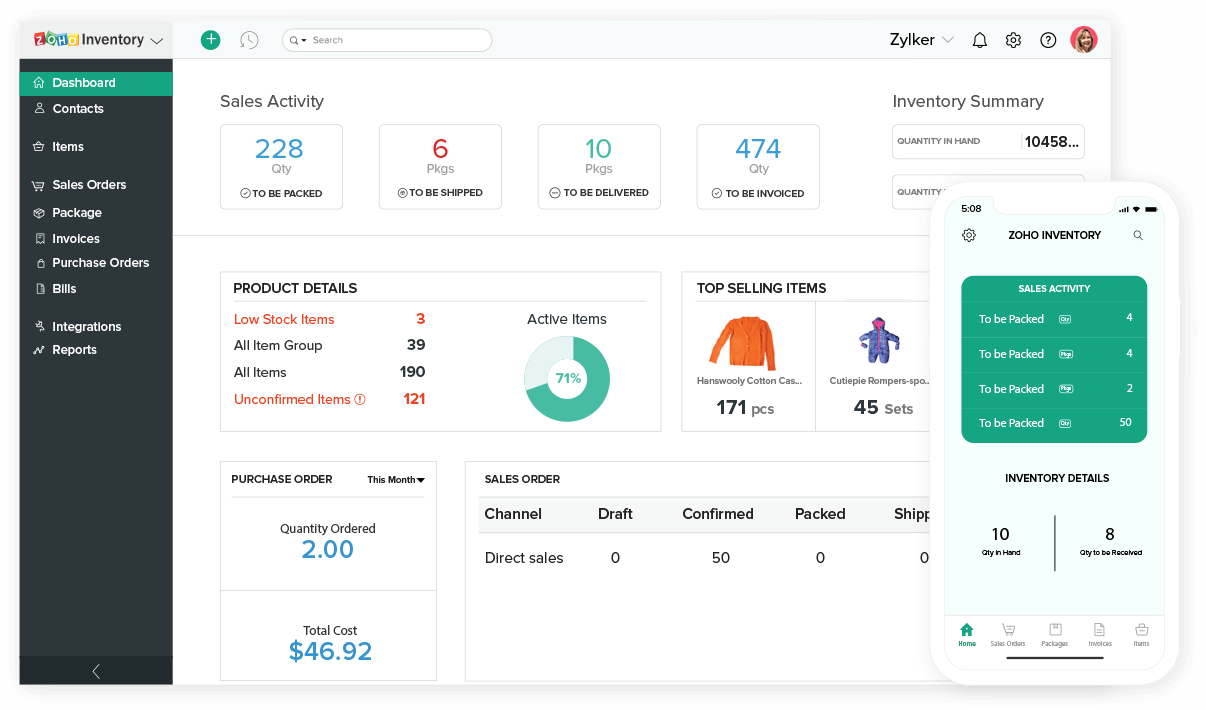

Cloud-based accounting and inventory management software is becoming increasingly popular for small businesses. It is affordable, easy to use, and can be accessed from anywhere with an internet connection.

Some of the advantages of cloud-based software include:

- Affordability: Cloud-based software is often more affordable than on-premise software, as you do not need to purchase and maintain your own hardware and software.

- Ease of use: Cloud-based software is typically designed to be easy to use, even for non-accountants.

- Accessibility: Cloud-based software can be accessed from anywhere with an internet connection, making it ideal for businesses with remote employees or multiple locations.

However, there are also some disadvantages to using cloud-based software:

- Security: Cloud-based software can be less secure than on-premise software, as your data is stored on a remote server.

- Reliability: Cloud-based software can be less reliable than on-premise software, as it is dependent on the internet connection.

Some popular examples of cloud-based accounting and inventory management software include:

- QuickBooks Online

- Xero

- NetSuite

On-premise Software

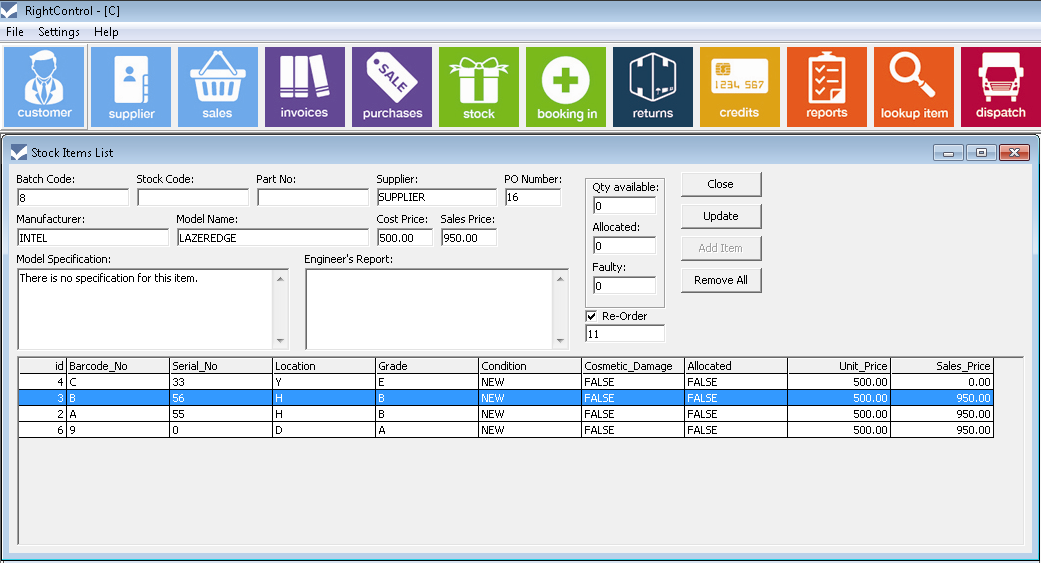

On-premise accounting and inventory management software is installed on your own computer or server. It is generally more expensive and requires more technical expertise to maintain than cloud-based software.

Some of the advantages of on-premise software include:

- Security: On-premise software is more secure than cloud-based software, as your data is stored on your own computer or server.

- Reliability: On-premise software is more reliable than cloud-based software, as it is not dependent on the internet connection.

- Customization: On-premise software can be customized to meet the specific needs of your business.

However, there are also some disadvantages to using on-premise software:

- Cost: On-premise software is generally more expensive than cloud-based software, as you need to purchase and maintain your own hardware and software.

- Complexity: On-premise software can be more complex to use than cloud-based software, as it requires more technical expertise to maintain.

Some popular examples of on-premise accounting and inventory management software include:

- Microsoft Dynamics GP

- Sage 50cloud

- SAP Business One

Implementation and Integration

Implementing accounting and inventory management software is a crucial step for small businesses looking to streamline their operations and improve efficiency. The process involves several key steps, including:

- Data preparation: Gather and organize all necessary financial and inventory data.

- Software selection: Choose the right software that aligns with your business needs and budget.

- Installation and setup: Install the software and configure it according to your business requirements.

- Data migration: Import existing data into the new software system.

- Training: Train staff on how to use the software effectively.

- Testing and go-live: Thoroughly test the system and make any necessary adjustments before going live.

Importance of Integration

Integrating accounting and inventory management software with other business systems, such as CRM or ERP, is essential for a seamless flow of information and improved efficiency. It allows for:

- Automated data transfer: Eliminate manual data entry and reduce errors.

- Real-time data sharing: Access up-to-date information across all systems.

- Improved decision-making: Make informed decisions based on consolidated data.

Best Practices for Smooth Implementation, Accounting and inventory management software for small business

To ensure a smooth implementation process, follow these best practices:

- Establish a clear project plan: Define goals, timelines, and responsibilities.

- Involve stakeholders: Get input from key users and departments throughout the process.

- Test thoroughly: Conduct rigorous testing to identify and resolve any issues.

- Provide ongoing support: Offer training and technical assistance to users after implementation.

Cost and Value

Accounting and inventory management software can vary in pricing depending on the features offered, the number of users, and the level of support provided. Here are some common pricing models:

- Subscription-based: A monthly or annual fee that provides access to the software and its features.

- Per-user pricing: A fee charged for each user who accesses the software.

- Tiered pricing: Different pricing plans with varying features and support levels.

- One-time purchase: A single upfront payment that grants perpetual access to the software.

The potential return on investment (ROI) for accounting and inventory management software can be significant. By automating tasks, reducing errors, and improving efficiency, businesses can save time and money. Additionally, improved inventory management can help reduce carrying costs and increase sales.

Calculating ROI

ROI = (Benefits – Costs) / Costs

To calculate the potential ROI, businesses should consider the following factors:

- Cost of the software

- Time saved by automating tasks

- Reduction in errors

- Improved inventory management

- Increased sales

The following table compares the costs and benefits of different software options:

| Software | Cost | Features | Benefits |

|---|---|---|---|

| Option 1 | $50/month | Basic accounting and inventory management | Automates tasks, reduces errors |

| Option 2 | $100/month | Advanced accounting and inventory management | Saves time, improves efficiency |

| Option 3 | $150/month | Premium accounting and inventory management | Reduces carrying costs, increases sales |

Customization and Scalability

Accounting and inventory management software can be customized to fit the specific needs of a business. This can include adding or removing features, changing the layout, and creating custom reports. As a business grows, the software can be scaled to meet its changing needs. This may involve adding more users, increasing the storage capacity, or upgrading to a more powerful version of the software.

Examples of Successful Implementations

- A small retail store used accounting and inventory management software to track its sales, inventory, and customer data. The software helped the store to improve its efficiency and profitability.

- A large manufacturing company used accounting and inventory management software to manage its complex supply chain. The software helped the company to reduce its costs and improve its customer service.

Security and Compliance

Accounting and inventory management software prioritizes the security of your financial data and inventory information. Advanced security measures are implemented to safeguard your sensitive data from unauthorized access, ensuring compliance with industry regulations.

The software employs robust encryption protocols, such as AES-256, to protect data both in transit and at rest. Multi-factor authentication and role-based access controls restrict access to authorized personnel only, preventing unauthorized individuals from accessing sensitive information.

Compliance

The software assists businesses in adhering to industry regulations, including GAAP, IFRS, and PCI DSS. It automates compliance processes, such as generating audit trails and maintaining accurate financial records, reducing the risk of non-compliance and potential penalties.

Case Studies

ABC Company, a leading manufacturer, implemented the software and significantly enhanced its security posture. The software’s encryption and access controls prevented a data breach attempt, safeguarding sensitive financial and inventory data.

XYZ Corporation, a retail chain, used the software to streamline its compliance processes. The automated audit trails and accurate financial reporting capabilities reduced the time and effort required for compliance audits, freeing up resources for other business activities.

Wrap-Up: Accounting And Inventory Management Software For Small Business

In conclusion, accounting and inventory management software for small businesses is an invaluable asset that empowers entrepreneurs to streamline operations, optimize decision-making, and gain a competitive edge. By embracing these powerful tools, small businesses can unlock their full potential and thrive in today’s dynamic marketplace.

FAQ Summary

What are the benefits of using accounting and inventory management software?

Accounting and inventory management software offers numerous benefits for small businesses, including improved financial accuracy, streamlined inventory control, enhanced reporting capabilities, and increased efficiency.

What types of accounting and inventory management software are available?

There are various types of accounting and inventory management software available, each tailored to specific business needs. These include cloud-based solutions, on-premise software, and industry-specific applications.

How do I choose the right accounting and inventory management software for my business?

Selecting the right accounting and inventory management software requires careful consideration of factors such as business size, industry, and specific requirements. It is recommended to research different options, read reviews, and seek professional advice if needed.